Inflation has reached an all-time high. Life is hard; we all have families to support, and extra money is always welcome and handy.

This post is about easy ways to make money online. And no, I am not talking about selling on eBay, Etsy, or Amazon, or exchanging your time for extra work on Fiverr or Upwork.

I am not talking about blogging, selling digital products, or affiliate marketing for passive income.

I am not referring to all that because those forms of earning money require work and effort at the end of the day. I am talking about lazy ways of making money—real passive income while you are sleeping or with minimal effort.

Affiliate Disclaimer:

Some of the links on this website are affiliate links, which means I may earn a commission if you click through and make a purchase. This comes at no additional cost to you. I only recommend products and services that I believe will add value to my readers. Thank you for your support!

1. High Yield Savings account

Regular savings accounts, at least here in the USA, offer between 0.1% and 0.5% interest—very minimal. High-yield savings accounts are primarily online accounts, which have fewer expenses than brick-and-mortar banks, allowing them to provide higher interest rates.

This is real passive income. You are making your money work for you and earning money literally while you sleep. The biggest effort is researching the best account for you, opening the account, and depositing the funds.

These accounts from 2023 to 2024 have offered interest rates between 4% and 5%. This interest can fluctuate depending on the Federal Reserve, which may be their biggest downside.

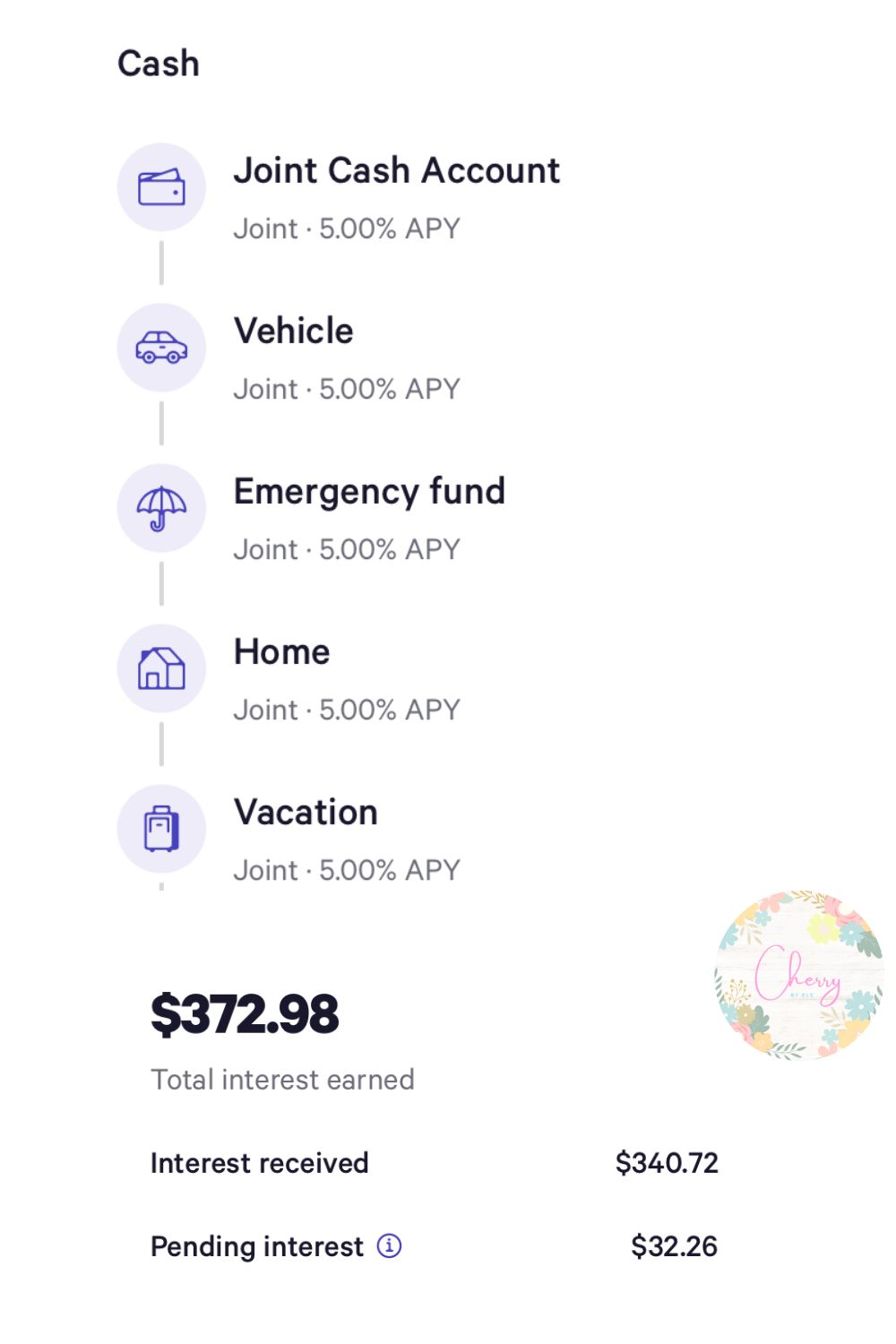

For example, I earned around $100 a year in interest with my brick-and-mortar bank. I had my Wealthfront account for less than six months, and I made a total of $372 during that time.

The beauty of these accounts is that your money is always available, and the investment is risk-free. There is also the benefit of compound interest, which is a nice advantage.

After extensive research, I opened an account with Wealthfront, which I really like for the following reasons:

- No Minimum balance or deposit.

- Zero fees, which is a significant advantage.

- Unlimited transfers and withdrawals.

- FDIC insurance up to $8 million, and up to $16 million in a joint account (most other accounts I researched only offer insurance up to $250,000).

- This is the only account of this nature that I know of where you can get a debit card (note: don’t apply for joint accounts).

- A very easy-to-navigate website and app.

- Wealthfront is also a great investing tool, allowing you to eventually open other kinds of investment accounts with them.

- You can organize your money into categories, which I love—this was a must-have feature for me. Below is an example of how I split the categories for my money.

I don’t have $8 million lying around, but if I ever sell my house, I would get a little more than $250,000. It’s nice to know that the entire amount would be insured.

If you are interested in opening a Wealthfront account, you can earn an additional 0.5% interest above their current APY for three months using my link here. You can find their terms and conditions for this promotion here.

2. Investing accounts and other investing tools

There are other ways to earn passive income by investing your money. There are tools we all know with little to no risk that offer good interest rates, such as retirement accounts, HSA or FSA savings accounts, and college accounts for the kids.

These accounts are for the long term and come with conditions regarding when you can withdraw your money; otherwise, you will be penalized. They also offer tax benefits. The downside is that you must leave your money in these accounts for a specific period.

Traditional banks also offer other investment accounts, such as money market accounts or certificates of deposit (CDs). Depending on the account type, you may need to keep your money in those accounts for a set period.

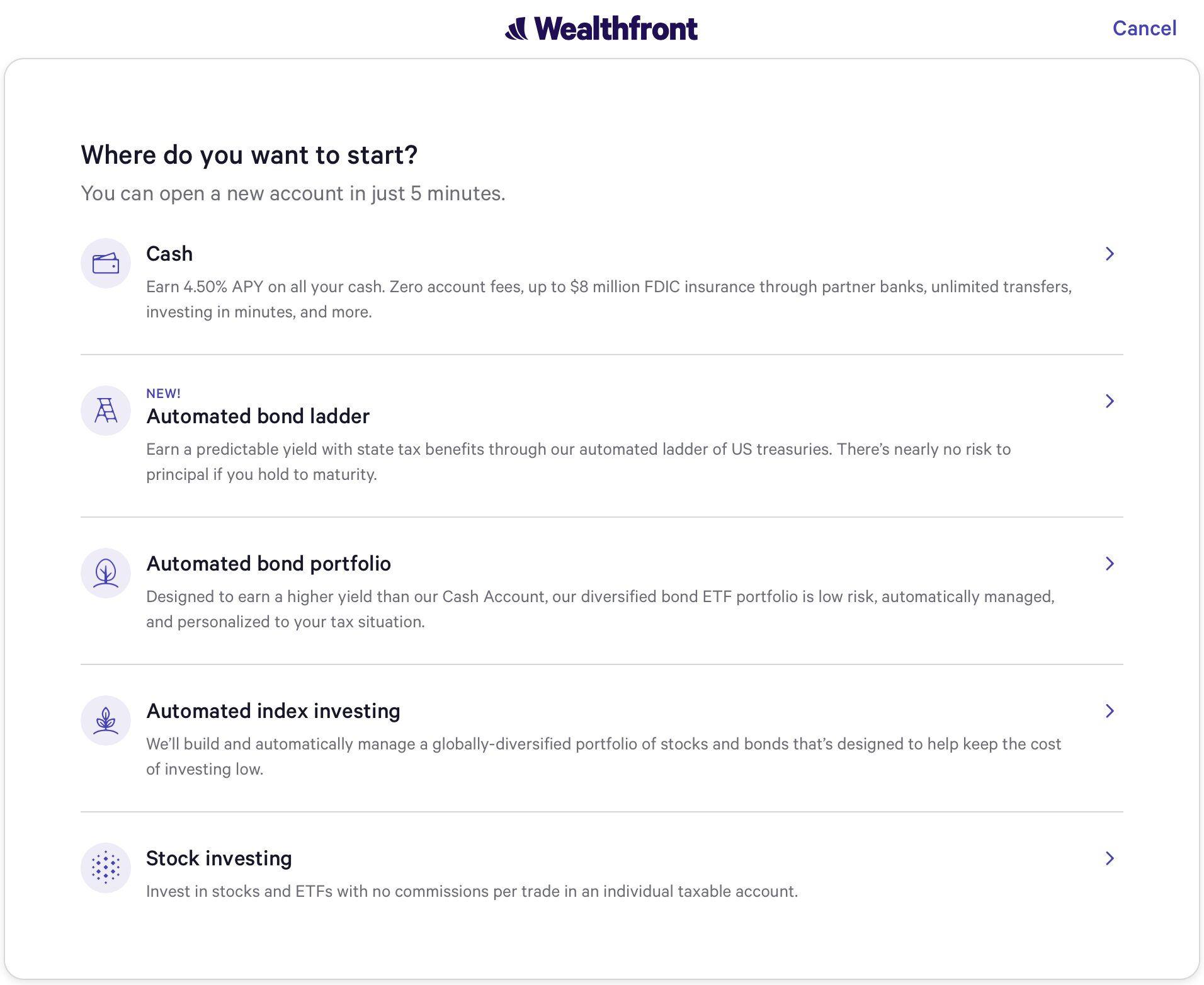

As I mentioned earlier, Wealthfront offers other investment tools besides its cash account. They have an Automated Index Investing account, where they build and manage a diversified portfolio personalized for you. They also offer IRAs and 529 college accounts.

Do your due diligence and research before selecting an account to invest in. Make sure you are comfortable with its fees and conditions.

Certain investment accounts may require you to leave your money for a specified period, and investing in the stock market or cryptocurrency carries the risk of losing your money if you’re not knowledgeable about it.

Conduct thorough research or consider hiring an expert to help manage your investments. Some advise against investing in any tool or account you don’t understand, especially in the stock market or cryptocurrency, unless you’re prepared to potentially lose that money.

3. Reward programs like Fetch

Fetch is an app where you can snap a photo of any receipt from a recent purchase at any store or restaurant, and they will give you points for it. You can then exchange those points for gift cards.

They also have a game section where you can earn even more points playing games on your phone. I wish somebody would pay me for all my time playing Angry Birds and Candy Crush.

Fetch offers a great variety of gift cards, including options from Amazon, TJ Maxx, Ulta, Bath & Body Works, Starbucks, Apple, AutoZone, Barnes & Noble, Belk, Big Lots, and Best Buy. They also have gift cards for restaurants like Chipotle, Chili’s, Burger King, and many more.

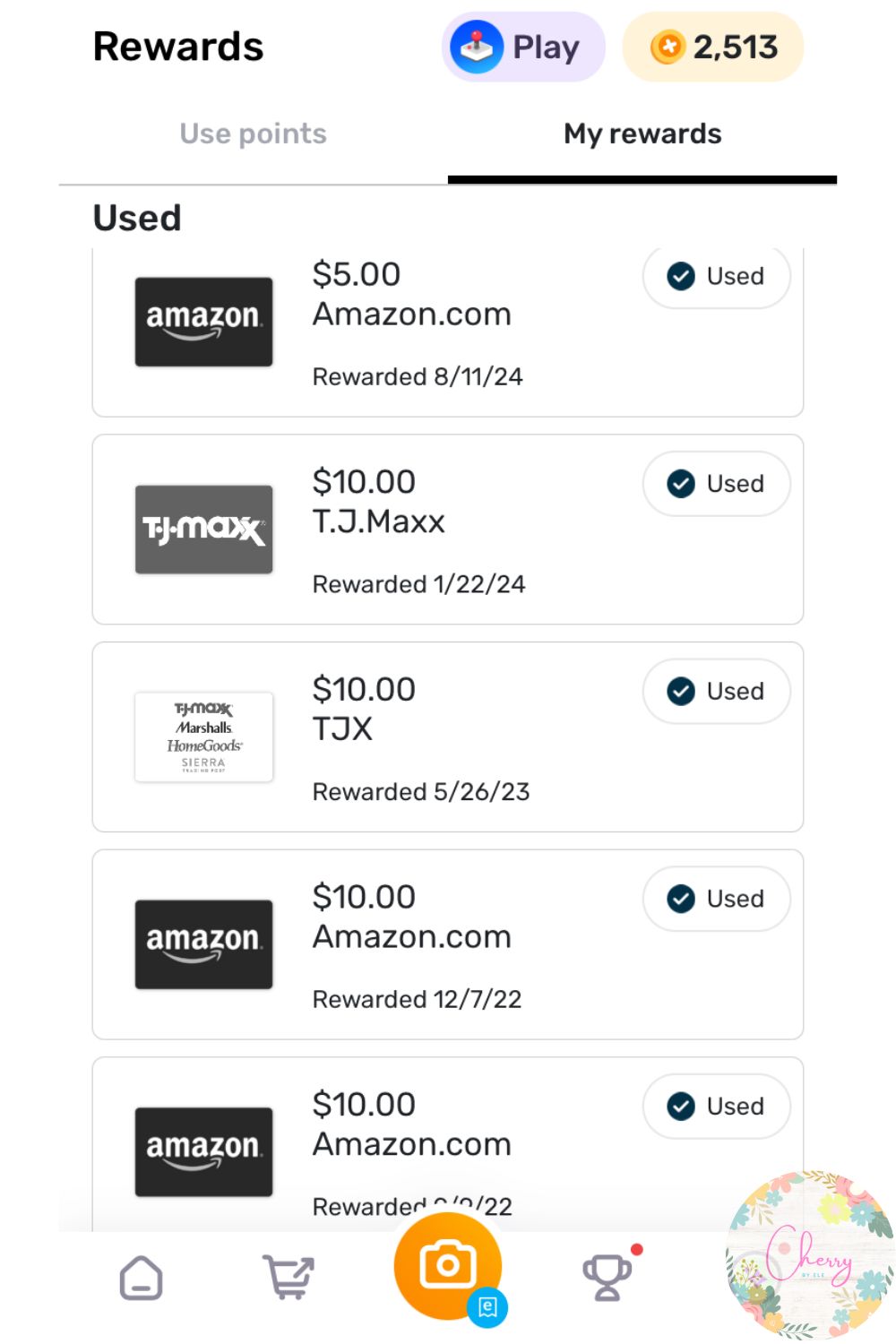

So far, I have earned $45 in Amazon and TJ Maxx gift cards. Snapping receipt photos is easy and takes just a second. As you can see, this is a very effortless way to earn rewards!

What I like about Fetch is that it is different from other reward programs. You don’t have to buy a specific product or brand repeatedly; we all need to buy groceries. You can scan those receipts for rewards.

You can also connect some accounts for online shopping with Fetch like Amazon and Walmart. This way you can add some extra points while shopping online.

If the store or product you purchase isn’t in their catalog, they may only give you 25 points, which is quite low and, in my opinion, not worth the hassle. I only snap receipts that I know will earn me a lot of points.

Fetch makes its money through affiliate marketing. However, what I don’t like about Fetch is that I feel I’m giving them a lot of my shopping information. This includes where you shop, what you buy, and how much you spend each month.

The app tracks all this information, and you can actually view it in a section of the app. This makes me think they might also sell marketing data—not necessarily your personal data, but your purchasing behavior data.

To avoid sharing too much of my information, I don’t snap every single receipt I have, as I mentioned before.

If you are interested in using Fetch, you can use my link to get extra points.

4. Rakuten, Honey, and other cashback and coupon extensions.

Cashback and coupons don’t make you money, but they save you money instead. This means more cash in your pocket at the end of the day.

Rakuten is a browser extension you can install. When you shop with brands associated with Rakuten, you’ll receive cashback. They also offer coupons, and there are many brands partnered with Rakuten.

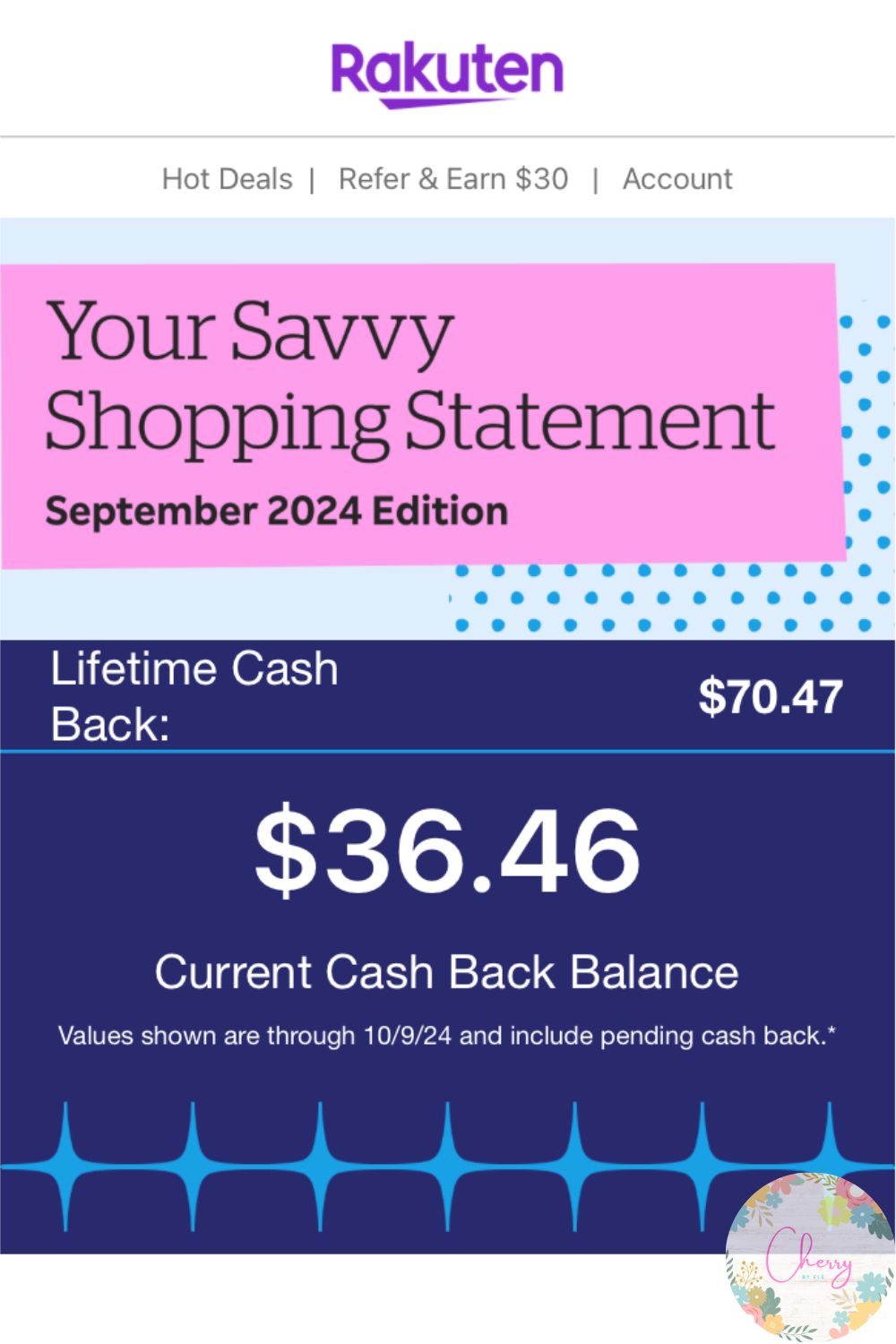

If you’re going to make an organic purchase, why not save some cash or at least get some back? You can receive your earnings in your PayPal account or via a check. So far, I’ve earned around $70. I know it’s not much, but it adds up.

On the Amazon website, Rakuten helps you find better deals outside of Amazon.

If you are interested in using Rakuten, you can use my link to get an extra 10% cashback.

Honey

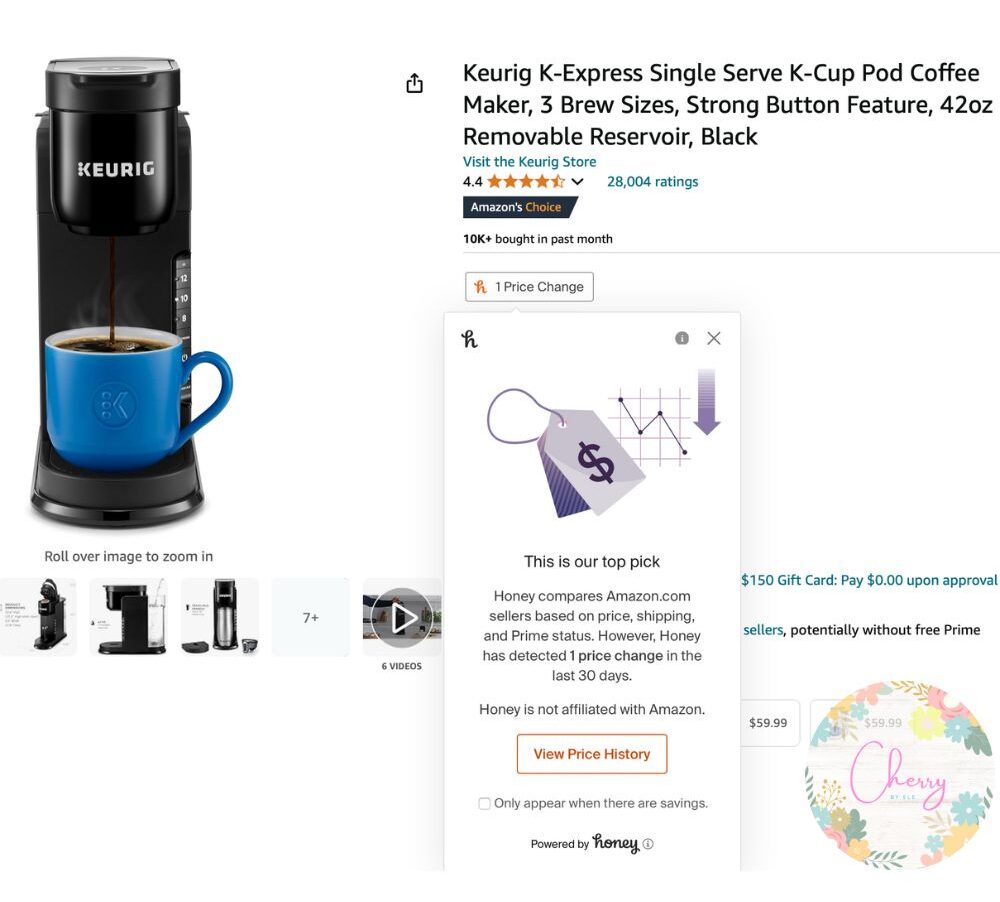

Like Rakuten, Honey is a browser extension that helps you find the best prices and gives you cashback on gift cards. On Amazon, Honey allows you to see if you’re getting the best deal and to track the historical prices of the products you like or need.

This is the best way to know if you are getting a real deal, especially on big sales like Prime Day or Black Friday.

Other coupon extensions.

When shopping online, I always try not to pay full price and aim to get the best discounts possible. I’ve noticed that if one extension doesn’t have a coupon, another might.

Coupon Birds doesn’t offer cashback or gift cards, but it helps you find coupons. Coupert is another extension that provides both cashback and coupons.

I really like these extensions because they allow me to avoid paying full price most of the time in my everyday shopping.

These extensions make money through affiliate marketing and selling marketing data (not your personal information).

Store Apps

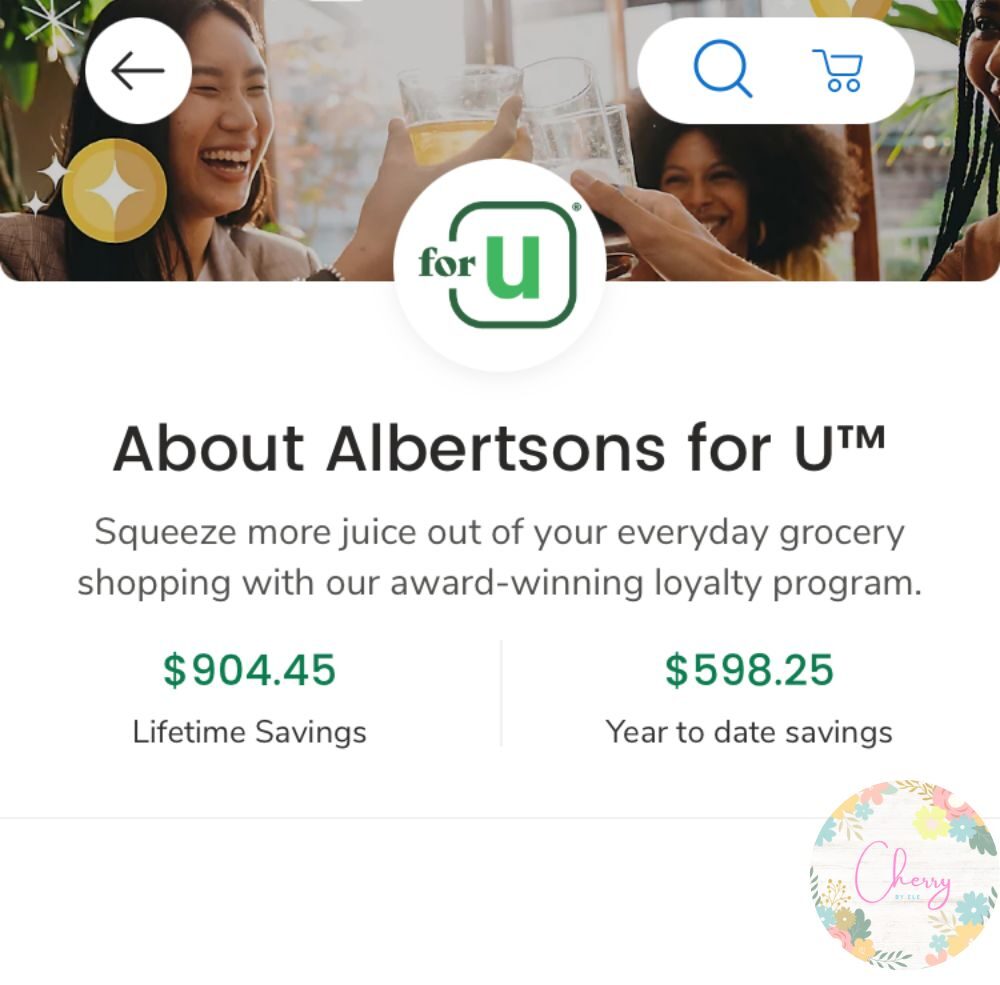

Some stores, like Albertsons or Dollar General, have apps that let you clip coupons and earn rewards/cashback as well. With these apps, I’ve saved between $3 to $20 on average every time I go to the store.

There was one time when we only paid $6 at Dollar General and saved $40 thanks to coupons and offers.

According to my Albertsons App, I have saved more than $900 since I started using it and more than $500 this year.

5. Answering Surveys

There are reputable survey companies that you can join to earn money. Survey Junkie and Branded Surveys are two good examples. Most of them pay in points, which can be converted into cash or gift cards, similar to rewards programs.

When you collect $5 or more, you can claim your payment, depending on the program you’re using. Most pay through PayPal or offer gift cards to retailers like Amazon and Walmart.

Each survey pays between $0.20 and $2.50. Generally speaking, a survey that pays $1 is considered well-paid. It’s safe to say that you won’t get rich answering surveys.

When creating a profile, you’ll be asked for your name, age, and address. They will also inquire about your gender, occupation, race, or ethnicity, whether you have children, and even your income.

All this information is required because you need to qualify for each survey. Pollsters look for specific demographics for each product or service.

If you don’t fit the target demographic, you may be disqualified right away, and the survey will end there. If that happens, you won’t earn anything.

If you do qualify, you can continue answering the survey, and you will be paid in points. Don’t be discouraged if you don’t qualify; it just means you’re not the target market for that particular product or service, so you can try another survey.

Typically, they will inform you before starting how many points you will earn and how long the survey will take. In my experience, it often takes twice as long as they say. For example, if they estimate 15 minutes, it usually ends up taking around 30 minutes of your time.

One thing I’ve noticed is that they generally don’t like you using a VPN, as location matters. This means you can’t pretend to be from another state or country.

This is my least favorite way to make money online because it requires more time and effort. I tried it once and made between $30 and $40. On the other hand, it’s nice to know that your opinion is valued for products and services.

Conclusion:

Would any of these options make you rich? Probably not, but unlike a side gig, these are very easy lazy ways to have extra cash in your pocket.