La inflación ha alcanzado un limite récord. La vida es difícil y todos tenemos familias que mantener. El dinero extra siempre es bienvenido y práctico.

Este post es acerca de las formas muy fáciles de hacer dinero en línea. Y no, no estoy hablando acerca de vender en eBay, Etsy, o Amazon, o intercambiar tu tiempo por trabajo extra en Fiverr o Upwork.

No estoy hablando de crear un blog, vender productos digitales, o de marketing de productos afiliados para obtener ingresos pasivos.

No me estoy refiriendo a estas formas de ingreso, debido a requieren trabajo y esfuerzo al final del día. Estoy hablando de formas relajadas de hacer dinero. Verdaderos ingresos pasivos mientras estas durmiendo o con el mínimo esfuerzo.

Deslinde de Responsabilidades de enlaces de afiliados.

Algunos de los enlaces en este sitio web son enlaces de afiliados, lo que significa que puedo ganar una comisión si hace clic y realiza una compra. Esto no tiene ningún costo adicional para usted. Solo recomiendo productos y servicios que creo que agregarán valor a mis lectores. ¡Gracias por su apoyo!

1. Cuenta de Ahorros De alto Rendimiento.

Las cuentas de ahorros normales, al menos aquí en los Estados Unidos, ofrecen entre el 0,1% y el 0,5% de interés, lo cual es mínimo. Las cuentas de ahorro de alto rendimiento son principalmente cuentas en línea, que tienen menos gastos que los bancos en una sucursal, lo que les permite ofrecer tasas de interés más altas.

Esto constituye ingresos pasivos de verdad. Estás haciendo que tu dinero trabaje para ti y genere dinero, literalmente, mientras duermes. El esfuerzo más grande es que investigues cual es la cuenta que mas te convenga, abras la cuenta y depósites los fondos.

Estas cuentas entre el 2023 y el 2024 han estado ofrecido tasas de interés entre el 4% y el 5%. Este interés puede fluctuar dependiendo de la Reserva Federal, que puede ser su mayor desventaja.

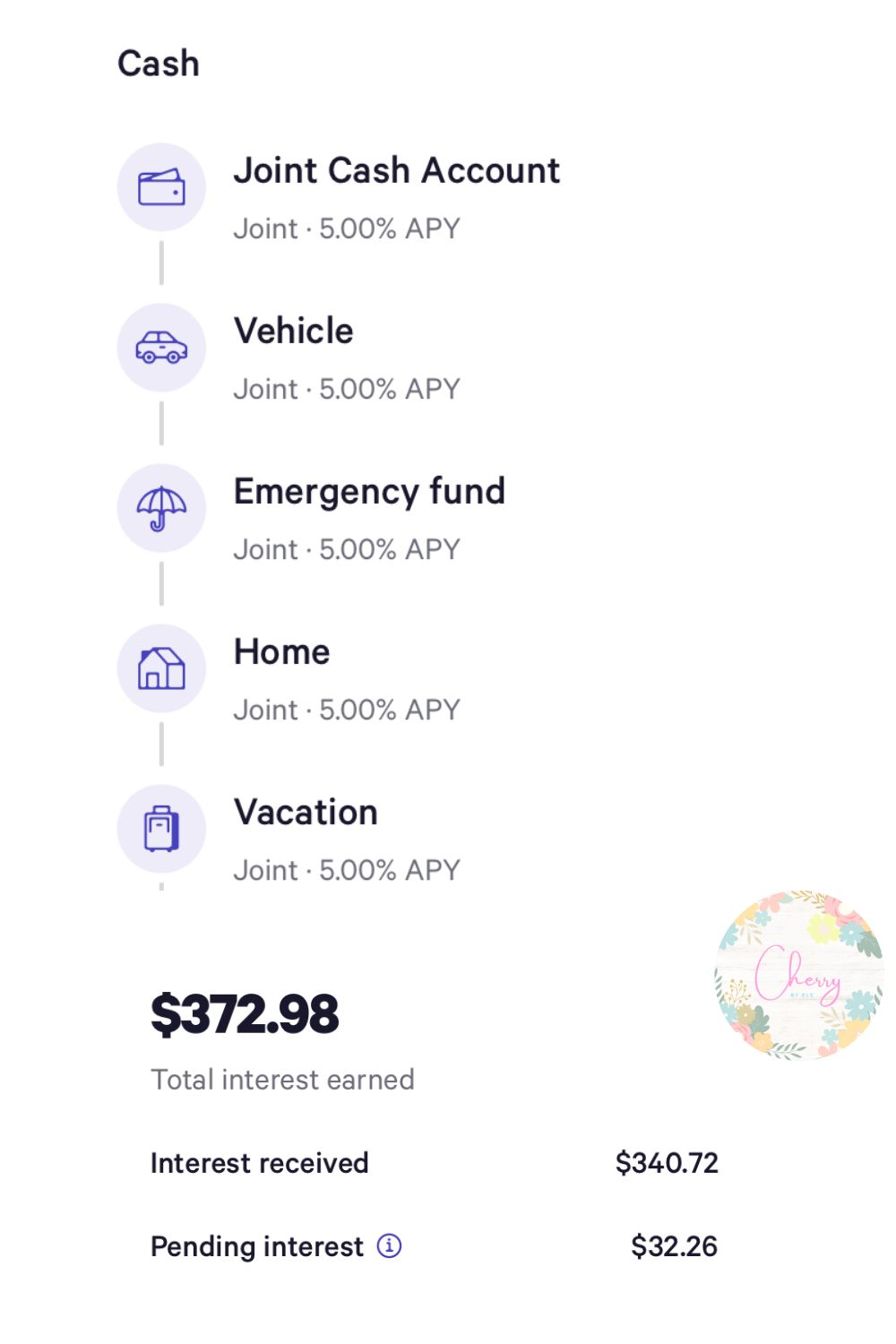

Por ejemplo, yo ganaba alrededor de $100 al año en intereses con mi banco tradicional. He tenido mi cuenta con Wealthfront por menos de seis meses, y he hecho un total de $372 durante ese tiempo.

La belleza de estas cuentas es que tu dinero siempre disponible, y constituye una inversión libre de riesgo. También existe el beneficio del interés compuesto, que es una buena ventaja.

Después de una extensa investigación, decidi abrir una cuenta con Wealthfront, que me gusta mucho, por las siguientes razones:

- No tiene saldo Mínimo o depósito minimo.

- Sin comisiones, lo cual es una ventaja significativa.

- Transferencias y retiros ilimitados.

- Asegurado por la FDIC por hasta $8 millones, y hasta $16 millones en una cuenta conjunta (la mayoría de las otras cuentas de este tipo que he investigado sólo ofrecen una suma asegurada de hasta $250,000).

- Es la única cuenta de esta naturaleza con la que se puede obtener una tarjeta de débito (nota: no aplica para cuentas conjuntas).

- Sitio web y app amigables, muy faciles de navegar.

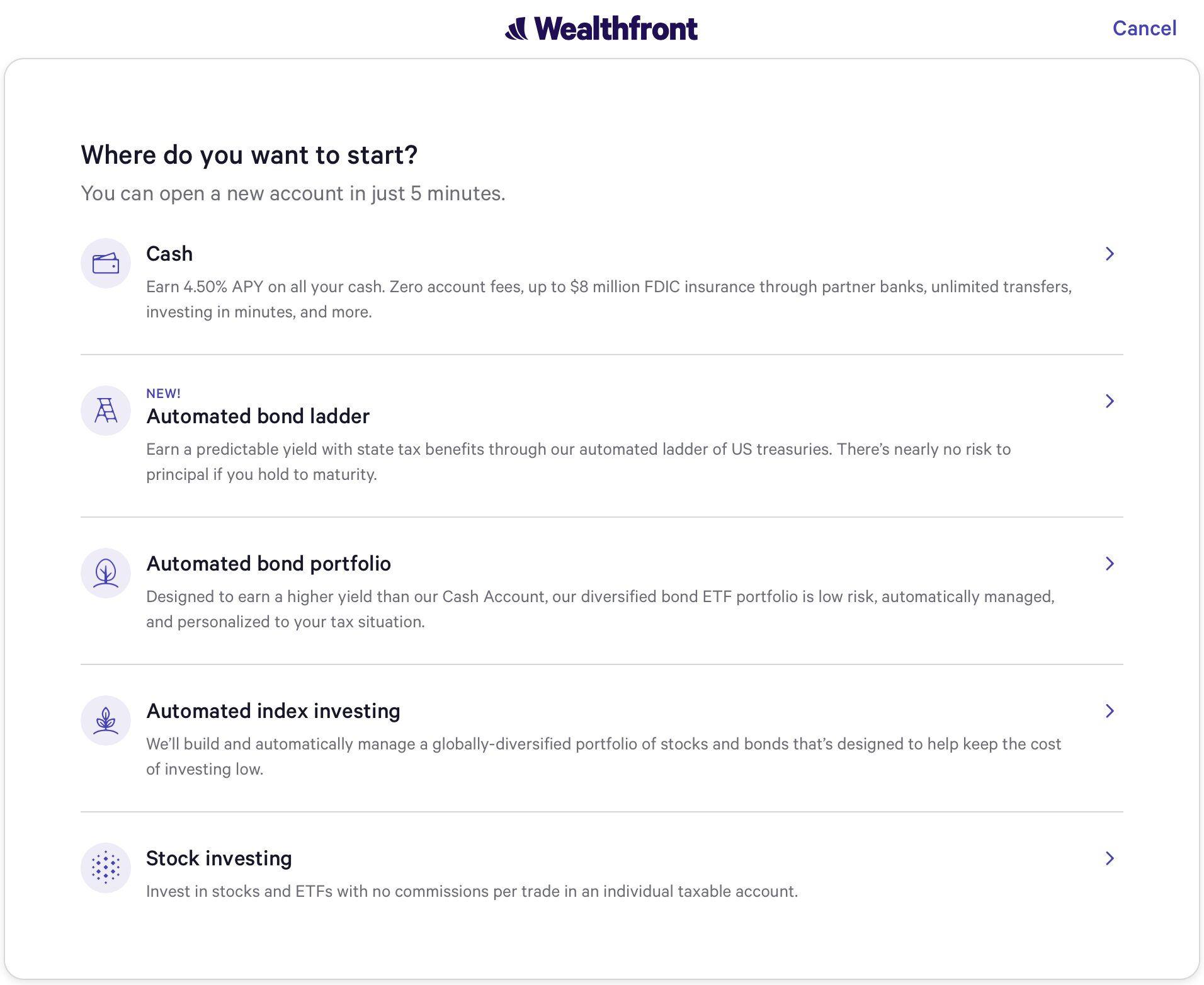

- Wealthfront también es una herramienta de inversion, que permite, eventualmente, abrir otros tipos de cuentas de inversión con ellos.

- Puedes organizar tu dinero en categorías, lo que me encanta (esta fue una característica indispensable en una cuenta personalmente). Aqui dejo un ejemplo de como se pueden dividir.

No tengo $8 millones, pero si llego a vender mi casa, estoy segura de que vale un poco mas de $250,000. Es bueno saber que todo el valor de mi casa estaria asegurado.

Si usted estás interesado en abrir una cuenta con Wealthfront, puedes ganar un 0,5% de interés adicional por encima del interes actual por los primeros tres meses de uso utilizando mi enlace aquí. Los términos y condiciones de esta promoción se encuentran aquí.

2. Cuentas de inversion y otras herramientas de inversión

Hay otras formas de ganar ingresos pasivos al invertir su dinero. Hay herramientas que todos conocemos, con poco o ningún riesgo de que ofrecen buenas tasas de interés, tales como cuentas de jubilación, cuentas de ahorro HSA o FSA, o cuentas para la universidad de los niños.

Estas cuentas son de largo plazo y con cuertas condiciones que se necesitan cumplir para poder retirar su dinero; de lo contrario, pueden haber penalizaciones. Estas cuentas también ofrecen beneficios fiscales. La desventaja es que el dinero debe permanecer ahi durante un periodo específico.

Los bancos tradicionales también ofrecen otras cuentas de inversión, tales como cuentas de mercado (money market) o Certificados de depósito (Cd). Dependiendo del tipo de cuenta, el dinero debe permanecer en la cuenta durante un período determinado.

Como he mencionado anteriormente, Wealthfront ofrece otros instrumentos de inversión, además de su cuenta de dinero en efectivo. Puedes construir y gestionar una cartera diversificada personalizada para ti con Wealthfront. Ellos también ofrecen cuentas tipo IRA y cuentas universitarias 529.

En relacion a los diferentes tipos de inversion que existen debes hacer tu debida diligencia e investigar antes de seleccionar una cuenta en la cual invertir. Asegúrate de estar cómodo con sus comisiones y condiciones.

Ciertas cuentas de inversión pueden requerir que el dinero permanezca ahi durante un período determinado. Las inversiones en el mercado de valores o en criptomonedas conlleva el riesgo de perder tu dinero si no estás bien informado acerca de como invertir en esas herramientas.

Es necesario realizar una investigación exhaustiva o considerar la contratación de un experto para ayudar a administrar sus inversiones. Algunos aconsejan en contra de invertir en cualquier instrumento o cuenta que no comprendas adecuadamente, especialmente en el mercado de valores o en criptomonedas, a menos de que esté preparado para la posibilidad de perder ese dinero.

3. Programas de recompensas como el de Fetch

Fetch es una aplicación en donde puedes tomar una foto de cualquier recibo de una compra reciente en cualquier tienda o restaurante y obtener recompensas a cambio. Los puntos se pueden canjear por tarjetas de regalo.

También hay una sección de juegos donde se puede ganar aún más puntos. Me gustaria que alguien me hubiera pagado por todo el tiempo que inverti jugando Angry Birds y Candy Crush.

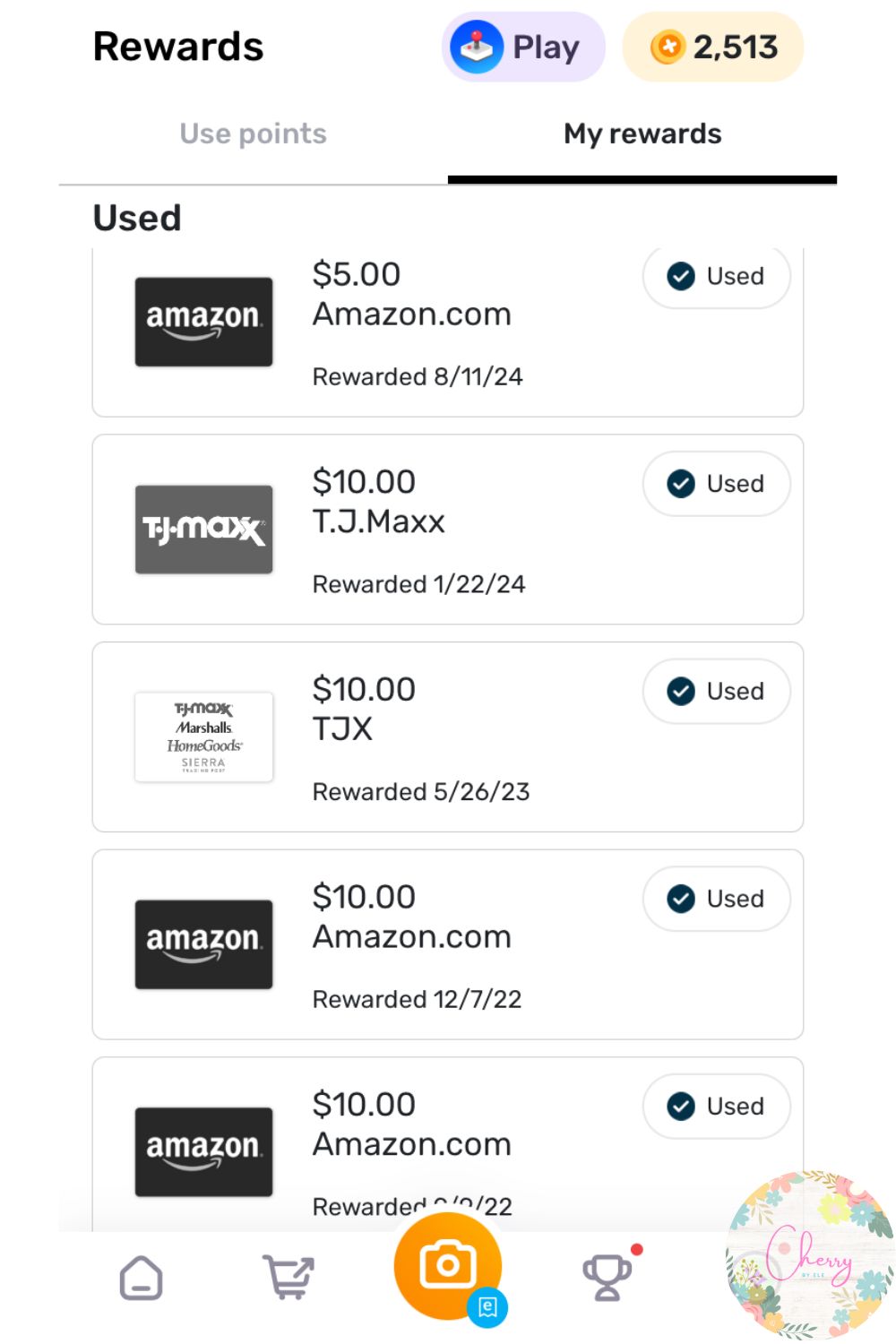

Fetch ofrece una gran variedad de tarjetas de regalo, incluyendo Amazon, TJ Maxx, Ulta, Bath & Body Works, Starbucks, Apple, AutoZone, Barnes & Noble, Belk, Big Lots, y Best Buy. También tienen tarjetas de regalo para restaurantes como Chipotle, Chili's, Burger King, y muchos más.

Hasta ahora, he ganado $45 en tarjetas de regalo en Amazon y TJ Maxx. Tomar la foto de un recibo es fácil y toma sólo un segundo. Como se puede ver, esta es una forma sencilla de ganar recompensas.

Lo que me gusta de Fetch es que es diferente a otros programas de recompensas. Usted no tiene que comprar un determinado producto o marca en repetidas ocasiones; todos necesitamos comprar el super. Puedes escanear esos recibos para obtener recompensas.

También puedes conectar algunas cuentas de compras en línea con Fetch como Amazon y Walmart. De esta manera usted puede agregar algunos puntos extra, mientras que realizas compras en línea.

Si la tienda o el producto que compras no está en su catálogo, obtienes 25 puntos, lo cual es mínimo y, en mi opinión, no vale la pena. Yo sólo capturo los recibos que sé que va a dar muchos mas puntos.

Fetch hace su dinero a través de enlaces de afiliados. Sin embargo, lo que no me gusta de Fetch es que yo siento que me estoy dando mucha información sobre las compras que realizo. Esto incluye donde comprar, qué comprar, y cuánto gastas cada mes.

La aplicación realiza un seguimiento de esta información, y se puede ver en una sección de la aplicación. Esto me hace pensar que también venden datos de marketing—no necesariamente mis datos personales, pero si el comportamiento de compras.

Para evitar compartir demasiado de mi información, no capturo cada recibo o compra que hago, como he mencionado antes.

Si usted está interesado en el uso de Fetch, se puede utilizar mi enlace para conseguir puntos extra.

4. Rakuten, Honey, y otras extensiones de cashback y cupones.

El Cashback (La devolución de un porcentaje de la compra) y los cupones no generan dinero, pero ahorran dinero en su lugar. Esto significa más dinero en su bolsillo al final del día.

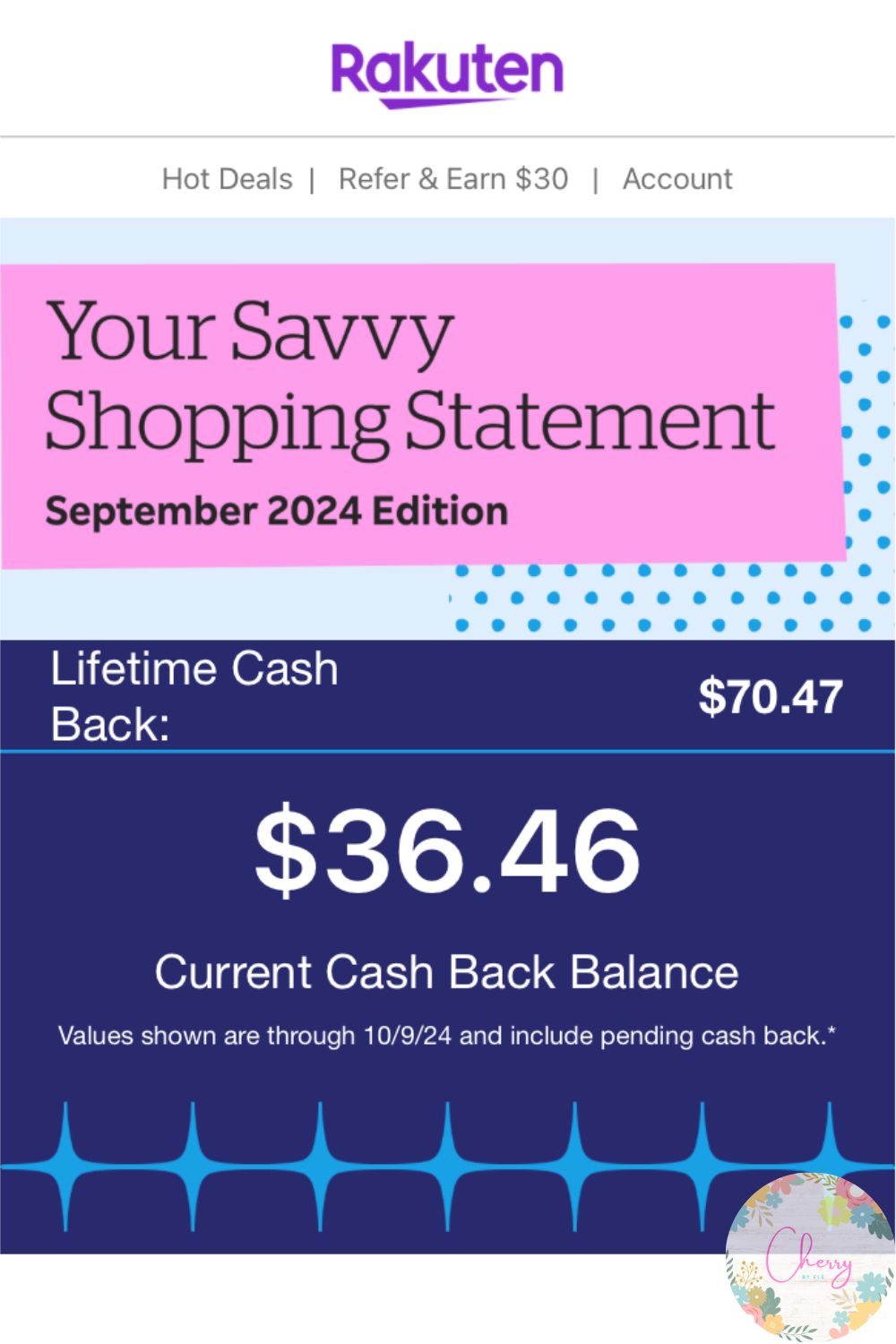

Rakuten es una extensión que se instala en el navegador. Cuando haces compras con marcas asociadas con Rakuten, recibirás un reembolso de un porcentaje de la compra. También ofrecen cupones de descuento. Hay muchas marcas asociadas con Rakuten.

Si vas a hacer una comrpa orgánica, ¿por qué no ahorrar algo de dinero o, al menos, obtener algo de dinero de regreso? Puedes recibir tus ganancias en tu cuenta de PayPal o a través de un cheque. Hasta ahora, he ganado alrededor de $70. Sé que no es mucho, pero todo suma.

En el sitio web de Amazon, Rakuten te ayuda a encontrar mejores ofertas fuera de Amazon.

Siestás interesado en el uso de Rakuten, puede utilizar mi enlace para obtener un extra de 10% de cashback.

Honey

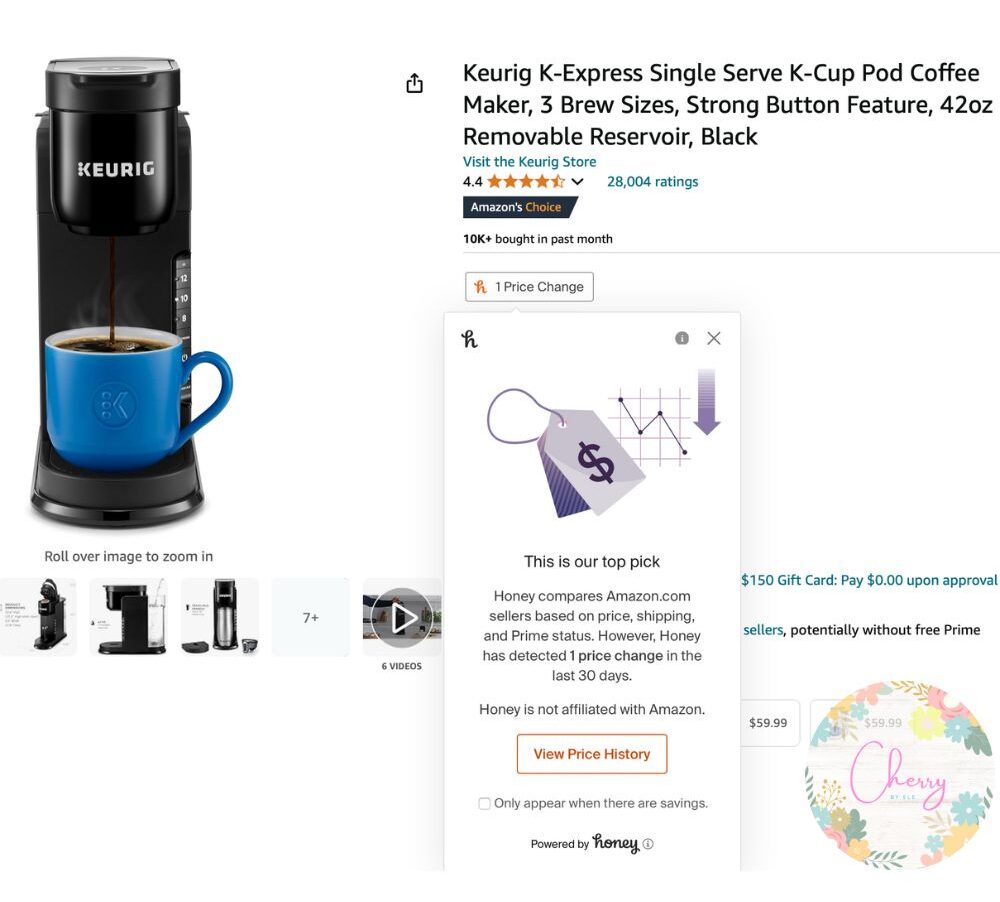

Como Rakuten, Honey es una extensión para el navegador que te ayuda a encontrar los mejores precios y te da cashback en tarjetas de regalo. En Amazon, Honey te permite ver si usted estas obteniendo el mejor precio y darle seguimiento a los precios históricos de los productos que te gustan o necesitas.

Esta es la mejor manera de saber si estás recibiendo una oferta real, especialmente en ventas como el Prime Day o Black Friday.

Otras extensiones de cupones.

Al hacer compras en línea, siempre trato de obtener algun descuento. Me he dado cuenta de que si una extensión no tiene un cupón, otra extension puede tener un descuento.

Cupón Birds no ofrece cashback o tarjetas de regalo, pero te ayuda a encontrar cupones. Coupert es otra extensión que proporciona tanto Cashback como cupones.

Me gustan mucho estas extensiones ya que me permiten evitar pagar el precio completo la mayoría del tiempo en mis compras diarias.

Estas extensiones hacen dinero a través de enlaces de afiliados y la venta de datos de marketing (no su información personal).

Aplicaciones de tiendas especificas.

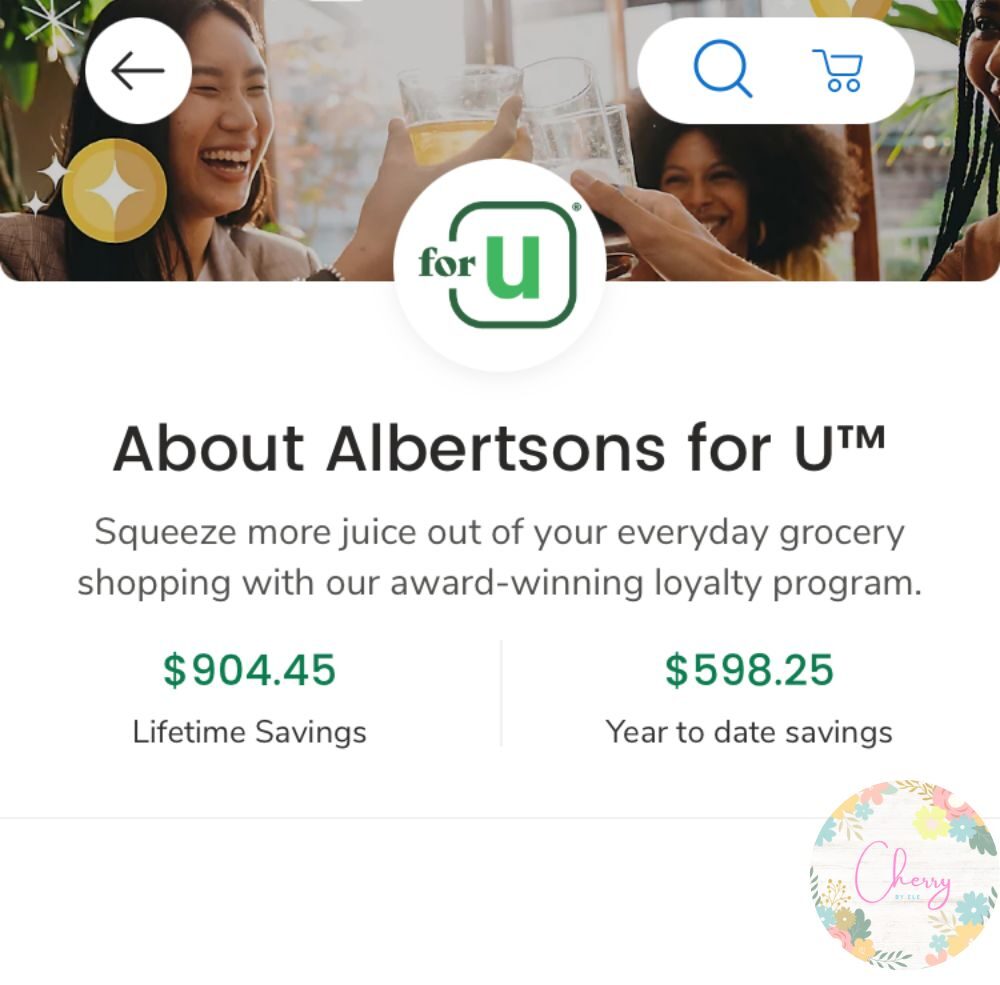

Algunas tiendas, como Albertsons o de Dollar General, tienen aplicaciones que te permiten recortar cupones y ganar recompensas/cashback tambien. Con estas aplicaciones, he guardado entre $3 a $20 en promedio cada vez que voy a la tienda.

Hubo una vez en la que termine pagando unicamente $6 en el Dollar General y ahorre $40 gracias a los cupones y ofertas.

De acuerdo a mi aplicacion de Albertsons, me han ahorrado más de $900 desde que empecé a usarlo y más de $500 este año.

5. Contestar Encuestas

Hay empresas reputables en las que puedes contestar encuestas para ganar dinero. Encuesta Survie Junkie y Branded Junkie son dos buenos ejemplos. La mayoría de ellos pagan en puntos, que pueden ser convertidos en dinero en efectivo o tarjetas de regalo, similar a los programas de recompensas.

Cuando juntas $5 o más, puedes reclamar tu pago, dependiendo del programa que estés usando. La mayoría pagana través de PayPal o ofrecer tarjetas de regalo de Amazon o Walmart por ejemplo.

Cada encuesta paga entre $0,20 y $2.50. Generalmente hablando, una encuesta que paga $1 se considera bien pagada. Obviamente no se hace uno rico contestando encuestas.

Al crear un perfil, se te pedirá tu nombre, edad y dirección. También preguntan sexo, raza, o etnia, ocupacion, si tienes hijos, e incluso tus ingresos anuales.

Toda esta información es necesaria debido a que necesitas calificar para cada encuesta. Los encuestadores buscan datos demográficos específicos para cada producto o servicio.

Si no encajas en el tipo de mercado que los encuestadores buscan, puedes ser descalificado desde el inicio, y la encuesta se termina ahí. Si eso sucede, obviamente no se obtiene el pago.

Si calificas, puedes continuar respondiendo la encuesta, y se obtener los puntos. No te desanimes si no calificas; sólo significa que no eres el mercado que ellos buscan para ese el producto o servicio en particular, por lo que puedes intentar contestar otra encuesta.

Normalmente, antes de comenzar la encuesta sabes la cantidad de puntos que se ganan y cuánto tiempo te llevará contestarla. En mi experiencia, se lleva el doble de tiempo que ellos dicen. Por ejemplo, si es un estimado de 15 minutos, realmente toma alrededor de 30 minutos de tu tiempo.

Una cosa que he notado es que generalmente no les gusta que el uso de una VPN, ya que la ubicación es importante. Esto significa que no puedes pretender ser de otro estado o país.

Esta es mi forma menos favorita de hacer dinero en línea, ya que requiere más tiempo y esfuerzo. Yo lo intenté una vez y gane entre $30 y $40. Por otro lado, es bueno saber que tu opinión es valorada para los productos y servicios.

Conclusión:

¿Alguna de estas opciones va a hacerte rico? Probablemente no, pero a diferencia de un trabajo extra para ganar ingresos, estas son formas muy fáciles y relajadas de tener dinero extra en su bolsillo.